Hurricane Insurance

Home / Hurricane Insurance

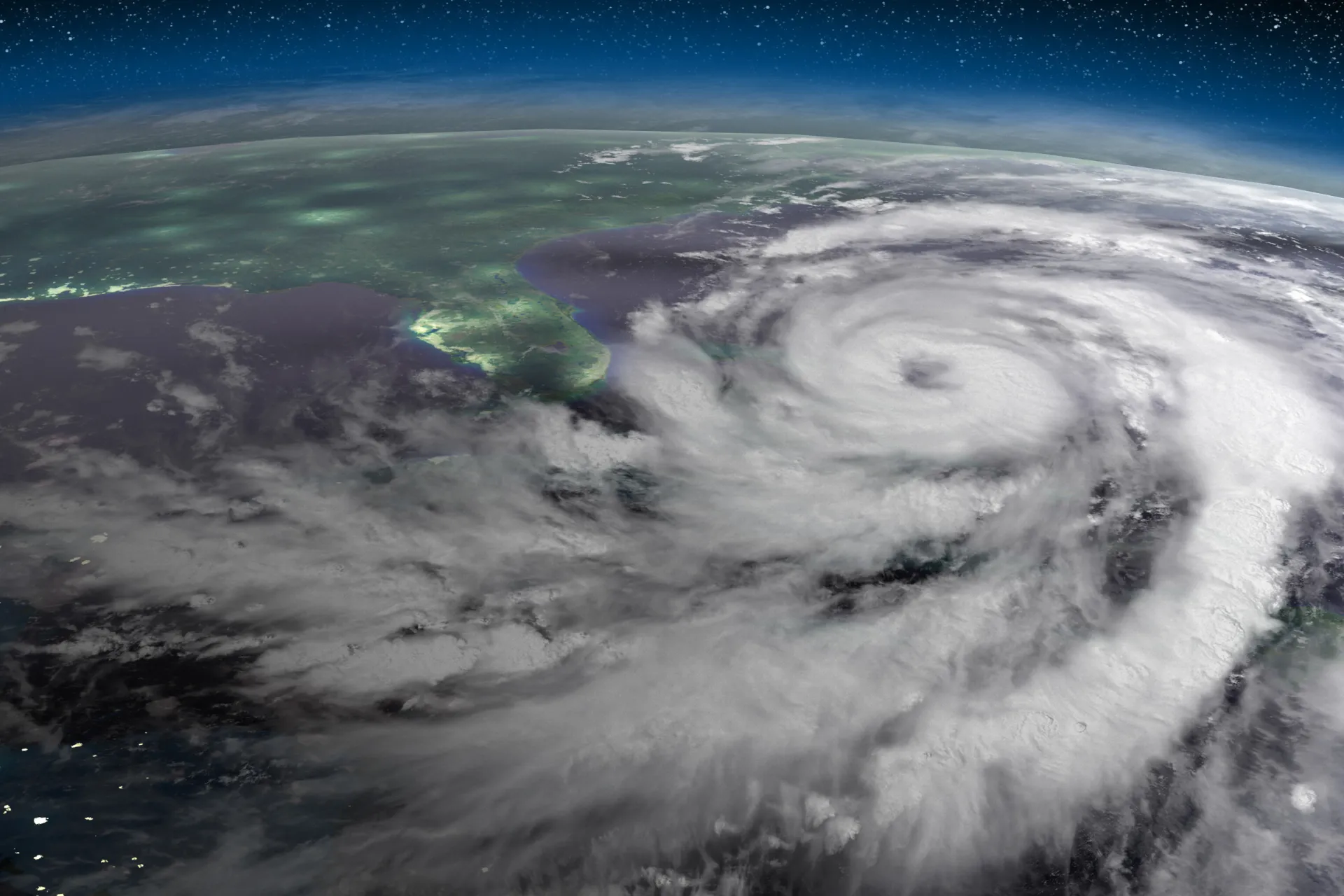

Protect Your Home Before and After the Storm

Before the winds begin to blow, understand what’s covered by your policy!

When the Winds Come, Will You Be Covered? Why Insurance Matters

Hurricanes are part of life in Florida, but the damage they cause can be financially devastating without the right insurance. Wind, wind-driven rain, and flood damage often go hand-in-hand, yet the resulting damage may or may not be covered depending on your insurance policy.

Wind vs. Flood: Understanding the Differences

Understanding the difference between types of storm damage is crucial when reviewing your coverage. Here’s what you need to know:

- Wind Damage

- Typically, standard home insurance policies offer coverage against strong winds (including hurricane winds), unless the policy is an x-wind policy and excludes wind damage.

- Review your coverages for damage limits: dwelling coverage for damage to the physical structure of your home and contents coverage for damage to your personal belongings and furniture.

- If a wind damage claim is caused by a hurricane, your policy’s hurricane deductible will apply.

- Flood Damage

- Damage by rising water such as such as storm surge or overflowing rivers is not covered under homeowners insurance.

- Even if the flooding occurs during a wind event, such as a hurricane, you will need a separate flood policy or endorsement to cover the flood damage.

- Flood coverage can be applied to all sorts of policies (homeowners, renters, condo, etc.) and can either be purchased through a private insurer or the NFIP. Read more about this specialized coverage by clicking here.

- Wind-Driven Rain

- Wind pushes rain at an angle, allowing it to hit vertical surfaces like walls and windows.

- Wind increases the force of the rain's impact, making it more likely to penetrate buildings.

- Wind-driven rain can enter homes through cracks and crevices in roofs, walls, doors, and windows.

- Important: Wind-driven rain may not be covered under standard homeowners insurance. Consult your agent to confirm your coverage.

- Why It Matters: Knowing these distinctions helps you understand what your policy protects and prevents surprises during the claims process.

Learn More About What's Covered

Be Ready Before the Storm Hits

Protecting your home from hurricane damage starts with preparation:

- Understand Your Financial Responsibility: In many instances, your hurricane deductible is a percentage of your coverage A amount. Review your out-of-pocket responsibility and make sure you’re comfortable spending that amount in case your home is impacted by a hurricane. Your hurricane deductible can be found on your declaration page.

- Review Your Policy: Double check whether you have both wind and flood coverage. If you don’t have this protection, talk to your agent about purchasing this add-on coverage.

- Strengthen Your Home: Install storm shutters, reinforce your roof, and secure outdoor items.

- Document Your Property: Keep a home inventory list up to date with a list of your property in case of a claim. Include as much information as possible, such as serial numbers, receipts, and photos.

Learn More About What's Covered

After the Storm: Steps to Take When it’s Safe to Return

If you experienced a loss, once the storm has passed, follow these steps to protect your property and start the claims process:

Inspect Safely

- Avoid hazards like downed power lines and standing water

Make Minor Repairs

- If the structure of your home will allow you to safely do so, take reasonable steps to prevent further damage to your home. Be sure to keep all receipts for potential reimbursement.

Document the Damage

- Take photos and videos of all affected areas.

File Your Claims Promptly

- Contact your insurer immediately to start the claims process.

Be Storm-Ready Before the Next Hurricane Hits

Hurricanes don’t wait, and neither should you. Protecting your home starts with understanding your coverage and acting now to fill any gaps. Talk to an agent to ensure that you have both wind and flood protection. Make sure to perform regular maintenance to protect your home.